The credit score of a small business owner impacts your personal and business finances. It affects applying for a business loan or showing investors you’re a stable business owner. And when it comes to buying a home, your credit score will influence whether or not you can purchase a home at a good interest rate.

In order to buy a house with a conventional loan, you simply need a median credit score above 620. But as a small business owner, with many demands on your cash flow, you don’t want to just qualify to buy a home. You want the BEST interest rate you can get.

A reduction of even 0.25% in your interest rate can save you hundreds of dollars a month and tens of thousands of dollars over the lifetime of a 30-year loan. In order to qualify for the BEST interest rates, you’ll need a credit score of 760 or better.

We recommend checking your credit score as soon as you decide you want to buy a house.

To see our full timeline of home-buying for small business owners, click here. [link to article & infographic]

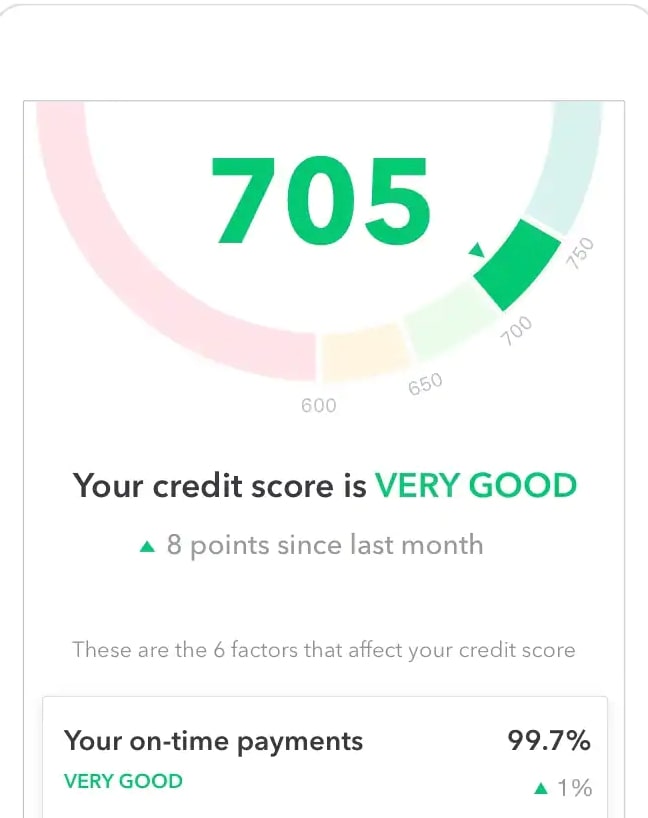

If you’re like most Americans, your credit score will land around 711. But don’t worry. You can move that credit score up over the next months or years during your home buying preparation. We’ll cover some of those tactics here and give you some tools to help you stay on track to reach your credit score goals.

Just like with most habits, it’s all about consistent movement in the right direction.

Credit Score Tool #1 – Accessing Your Credit Report

Did you know you can request a free copy of your credit score every year? And that’s a free report from each of the three credit scoring agencies.You’ll be able to receive a free credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion.

You can view your credit report by visiting AnnualCreditReport.com and requesting your free credit report. You can also order your credit report by calling 877.322.8228 or by completing the Annual Credit Report Request Form and mailing it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Items That Affect Your Credit Score – Prioritized

Once you have your credit reports, you’ll want to take the median score of the three. That’s your starting point. If you’re at 760 or better, well done you! You have a better than average credit score.

If your score is under 760, you’ll want to use the time you have to get that number as high as possible before you apply for a mortgage.

And guess what? You can still work toward a higher credit score after you submit your loan application. Most lenders don’t lock in your interest rates until you have an accepted offer.

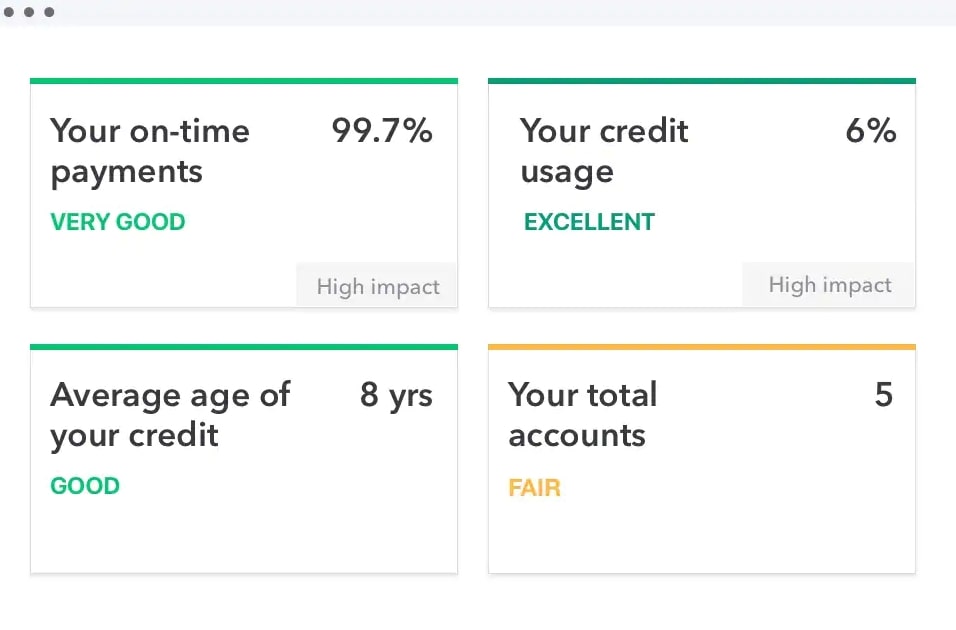

So, what are the things that you might want to consider working on? Here’s the list of items that determine your credit score from highest to lowest impact.

- Payment history. Whether or not you make your debt payments on time each month has the biggest impact on your credit score. Each time you miss a payment it is reported to a credit agency, and negatively affects your score. So staying up-to-date with payments while shopping for a home should be priority #1.

Late or missed payments typically stay on your credit report for up to 7 years after the due date of the late or missed payment. But seven years is a long time to wait for a better credit score, so…

Can you get a late payment removed from your credit report? Maybe.

If you see a late payment on your credit report in error, you can dispute it. The resolution takes a little time, but it can be done. You should first contact the creditor to report the error and ask them to remove it. But ultimately, you can also dispute it with the credit bureaus with proper documentation.

If the late payment is accurate, you can still request a goodwill removal of the late payment from your creditor or lender. Sometimes lenders will write to the credit bureaus to remove a late or missing payment if you a.) make good on the debt, b.) have an otherwise great payment record, c.) give them a legitimate reason for the late payment, and d.) note why and how you will not allow the mistake to happen again.

Creditors do not have to fix any accurate reports of late or missed payments. But they certainly won’t if you don’t ask.

- Debt to available credit ratio. How much credit you use compared to how much credit you’re approved to use largely impacts your credit score.

What does that really mean? Think of your credit card’s available credit limit. What percentage of that credit limit are you using?

People using 10% or less of their available credit win the highest credit scores. But using anything over 20% of your available credit will start to drive your credit score down quickly.

As a remedy, some people think they should open new credit accounts. But that doesn’t always work out the way you think it should. The next few items on the list will show you why.

- Length of credit. Lenders like to see a long history of credit usage and payments. And that accounts for 15% of your credit score. So, if you open several new accounts to increase your credit limit, you could still be driving your credit score down because you haven’t had a long history with that amount of credit.

- Account diversity. If you only have one type of credit (e.g. credit cards), you might also be driving your credit score down. Lenders like to see multiple types of credit on your account. For example, credit cards and an auto loan would be considered more diverse than credit card debt alone.

- Credit Inquiries. Before you open new accounts to increase your credit limit or create credit diversity, you might want to consult a credit specialist. That’s because too many credit inquiries in a short period of time (i.e. 2 years) can indicate a desperation for money. And that can also reduce your credit score.

This has one of the lowest impacts on your credit score, so an inquiry or two might be worth the diversity or increasing your credit limit. And that’s why consulting a credit specialist can help you make the right decision based on how long you have before you need to apply for your mortgage.

If you’re looking to increase your credit score yourself, we have a few more tools that provide personalized recommendations to help you increase your credit score. They’re easy to use on your computer or your phone. And they all offer great insight for increasing your score as quickly as possible.

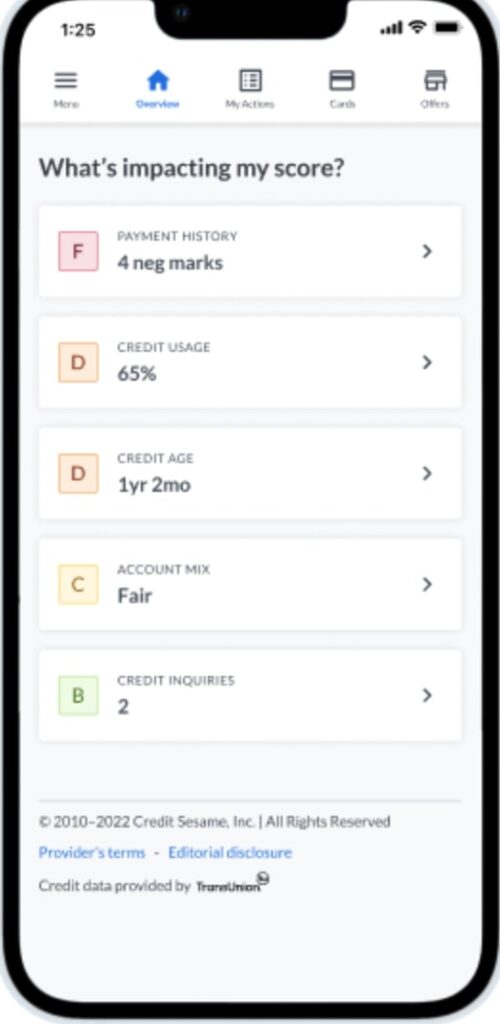

Credit Score Tool #2 – Mint by Intuit

Intuit, the same company that created Quickbooks and TurboTax, provides us with a budgeting tool called Mint. If you already use Quickbooks or TurboTax, Mint might be the credit score tool for you.

Some of our favorite things that Mint has to offer include a biweekly update on your credit score. And this incorporates the ability to drill into the areas that are having the highest impact on your current score.

We love how you can watch your credit habits affect your credit score as you work toward your goal. And that’s all included in the free version of the app.

You can also connect Mint with all your accounts, and they offer a pretty cool budgeting interface. You can easy track overspending each month. And they provide “mintsights” to help you save more, pay down debt, and increase your credit score.

They’ll even send you alerts about subscriptions or fees you’re charged by different creditors. And they offer options to transfer credit balances to lower your credit payments.

Mint also offers other paid services, like bill negotiation to reduce the amount of cash coming out of your pocket each month.

Credit Score Tool #3 – Credit Sesame

Credit Sesame provides another online tool that can help you monitor your credit score. And similar to Mint, it allows you to see what’s negatively impacting your score, so you can fix it.

Credit Sesame offers services very similar to Mint. However, they do offer a “credit building” service that we haven’t seen on the Mint platform.

“Credit building” means you agree to a small loan from their lending services, where they take money out of your bank account each month. Because it looks like a loan, it helps you establish credit and on time payments, which can positively increase your credit score. And they only run a soft inquiry on your credit account, so it doesn’t count as a credit inquiry on your credit score.

Their promise is you can increase your credit score in as little as two months with only $10 per paycheck. This sounds interesting, but it does seem like consulting a credit specialist might be a good idea before signing up.

Credit Score Tool #4 – Credit Karma

You might be thinking, wait a minute, why doesn’t Mint offer the “credit building” service? Well, a close relative of the Mint software offers a similar service.

Intuit acquired Credit Karma at the end of 2020. So, while Mint doesn’t offer the “credit building” service, Credit Karma does.

And that’s not all. While Credit Karma provides very similar services to Mint and Credit Sesame, they do offer one of our favorite tools on the Credit Karma platform – unclaimed money. They basically point you in the right direction (to the correct website) of all the places where you might have unclaimed money.

You may be wondering how “unclaimed money” even happens. Sometimes it’s a result of some distribution from a forgotten investment. They didn’t have your latest contact information, so there was no way to get you the money. It could be uncollected sales commissions with previous employers (yep, that old MLM is finally going to pay off).

It could also be things like class action settlements that you didn’t even realize were happening on your behalf. (One of my favorites was a check for $0.28 from an Amazon class action settlement. Don’t spend that all in one place!

Credit Score Tool #5 – Credit Wise by Capital One

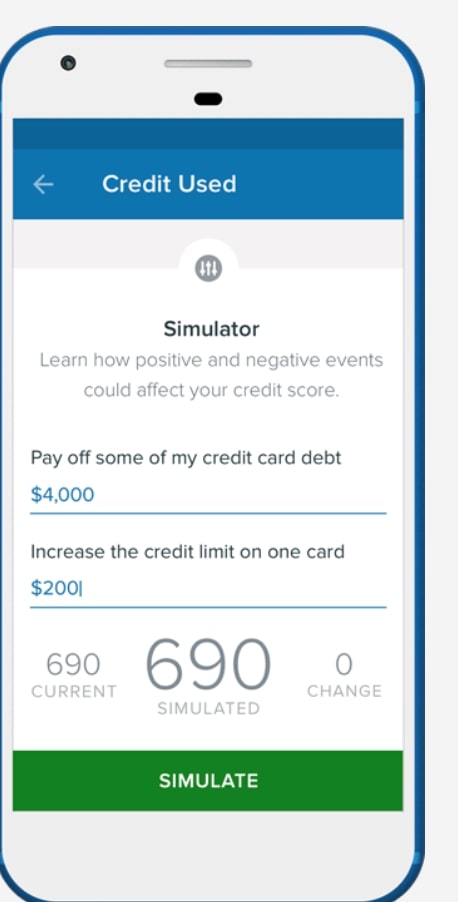

Again, this tool is a credit score monitor, like the others. However, Credit Wise by Capital One provides a Credit Score simulator.

The other applications give you an indication of what you should focus on first to increase your credit score. Credit Wise will actually simulate what a particular action will do for your credit score BEFORE you make it.

For instance, paying down some credit card debt. You’ll enter your numbers, and the simulator will show you just how much that should increase your credit score.

It’s a great way to weigh saving cash vs paying down debt.

Take-away

Each of these credit score tools provides a ton of great information about how to increase your credit score. But the hard work is still up to you. Making consistent progress on your credit score can help you get the best mortgage, for the best rate – saving you time and LOTS of money when buying a home.

How long does it take to increase your credit score? Bankrate offers some great insight in this article on your credit score timeline. And the Credit Wise credit score simulator can offer a personalized timeline for you.

But, the good news is, some of the actions you take to increase your credit score can pay off within 2 weeks to 3 months. And even with missed payments your score can start to recover within a year.

So, what do you need to do to increase your credit score as quickly as possible?

- Review your credit report.

- Use tools to help you navigate what actions will have the greatest impact.

- Create consistent progress. Get started and keep working on it every month.

- Track your progress quarterly and celebrate how far you’ve come. On top of your credit score, don’t forget to celebrate how much debt you’ve paid off. Reviewing key data points and celebrating will keep you excited about moving forward.