Ada County experienced a record breaking surge in home prices with a $33,000 increase from February to March. This is the largest month over month increase in county history. Due to scarce inventory and continued buyer demand, the real estate landscape of 2024 is proving advantageous for home sellers.

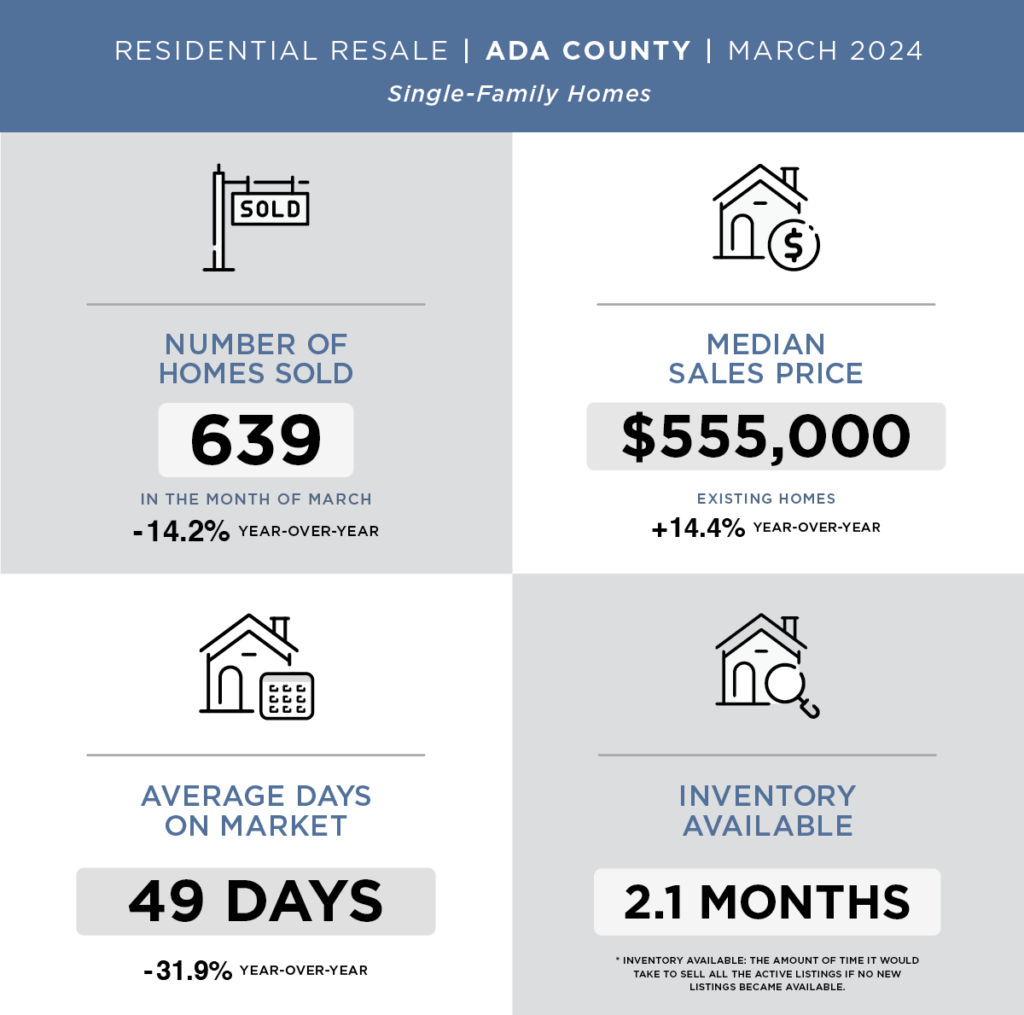

The median home price in Ada County for resale was $546,000 and $567,000 for new construction, reaching a combined median home price of $555,000. This record-setting month also coincides with the largest yearly gain since May 2022.

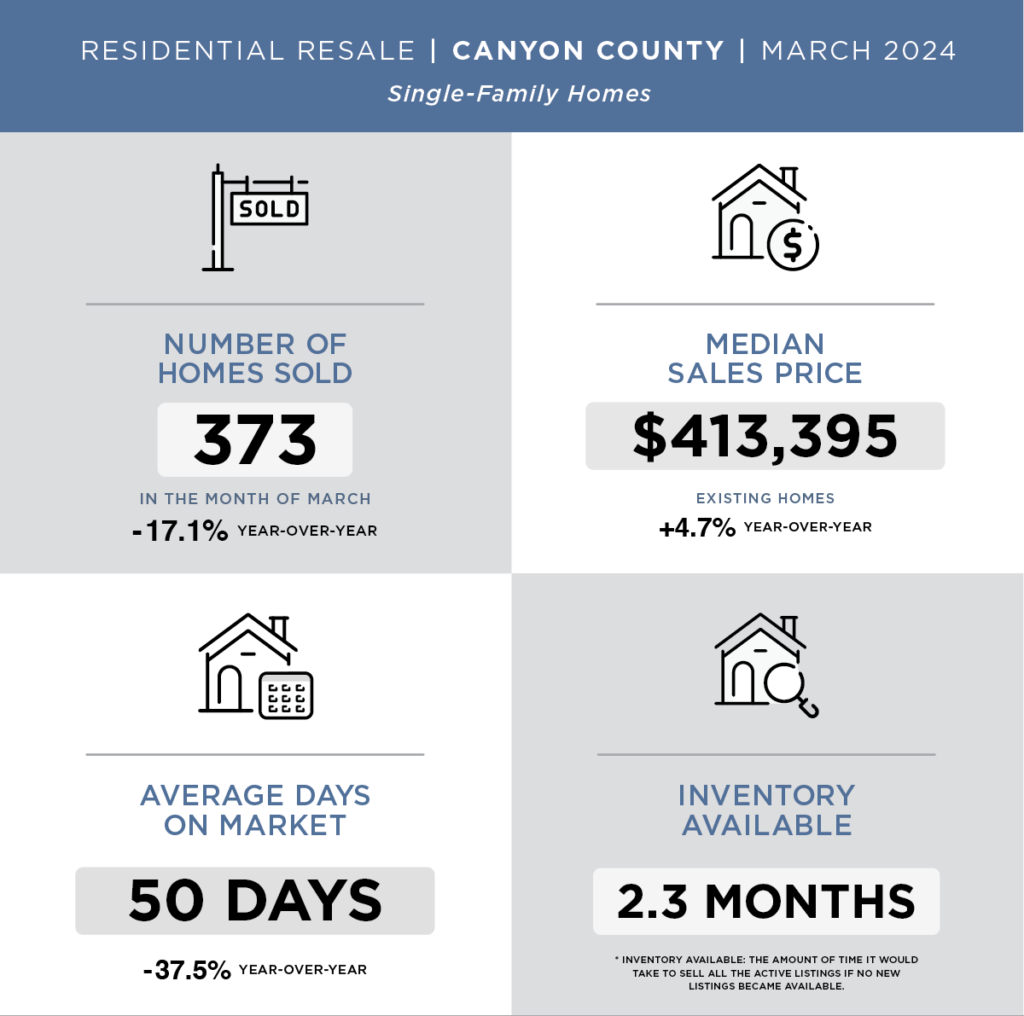

The median home price in Canyon County for resale was $393,450 and $429,990, for a combined median home price of $413,395.

Additionally, according to Architecture Lab, Idaho takes the first-place trophy in home-price increases over the last decade in examined data from Zillow. The average home value in Idaho in 2013 was $159,567, while in 2024 it was $432,476 — an 171% increase, according to the study.

The upsurge in prices is attributed to strong demand from buyers less sensitive to interest rates, coupled with a limited supply of available homes on the market.

30-year mortgage rates experienced a slight increase to 7.1% this week. While inventory continues to remain low with just over a two month supply as we head into the summer months, the scarcity of existing homes further amplify the supply and demand situation. Despite demand and lack of available homes, which is the formula for a sellers market, homeowners are hesitant to make a move as the current mortgage rates outweigh the equity benefit of selling.

Boise Regional Realtors reports that existing homes spent 8 days less on the market compared to the month prior. While year-over-year comparisons may show a slowdown in the pace of price increases due to last March marking a low point in local home prices, prices are expected to continue rising, barring significant economic changes.

Looking Ahead

The Federal Reserve foresees three rate cuts this year and three more next year. Reduced mortgage rates might incentivize a greater number of homeowners to consider selling. As the margin between the interest rates of 2020 and current market rates narrows, we could see an increased supply of homes entering the market in the fall and early spring of 2025.

The decline in the number of sellers listing their properties is not the only factor contributing to the housing market’s challenges; rather, the impact of increased interest rates on home construction has also been significant. This has intensified an ongoing shortage, resulting in sustained high prices despite the decrease in sales of both new and existing homes caused by elevated mortgage rates.

Beyond Idaho

According to Bankrate, as of February 2024, the median home-sale price stood at $384,500, marking a 5.7 percent increase from the previous year, according to data from the National Association of Realtors (NAR).

Concurrently, the housing inventory in the nation was reported to have a 2.9-month supply, a level deemed low enough to classify as a seller’s market, as indicated by NAR.

Based on the latest Case-Shiller Index from S&P CoreLogic, home-price growth surged by 6 percent in January 2024, marking the most rapid annual growth since 2022.

Bankrate’s most recent national survey of major lenders revealed that the average rate on a 30-year mortgage reached 7.05 percent as of April 3, 2024. These factors coincide with a U.S. inflation rate of 3.2 percent as of February 2024, which continues to surpass the Federal Reserve’s stated goal of 2 percent.

The Waiting Game

As we navigate the Idaho real estate market, it’s evident that both buyers and sellers are currently waiting favorable conditions to make their move. Prospective buyers are keeping a watchful eye on interest rates, hopeful for a downward trend that could potentially enhance their purchasing power. Conversely, sellers find themselves grappling with the decision to release their grip on their existing mortgage rates in order to transition to new opportunities.

But one thing remains clear, the real estate market in the Treasure Valley continues to reflect the broader economic landscape – the delicate balance of supply and demand influenced by factors such as interest rates, buyer demand, and seller sentiment.

As we look ahead, staying informed and remaining adaptable will be essential for everyone in this ever changing market.